2022 Year-End Tax Planning Opportunities

Our “2022 Year-end Tax Planning Opportunities” guide can be downloaded by clicking here.

Reviewing your investments in light of your goals, the tax policy environment and the economic landscape can help you see where adjustments need to be made to position yourself for 2023 and beyond.

The information contained in our guide is accurate at the time of writing (October 2022), and the Canadian government may introduce new tax measures before the end of the year.

If you have questions regarding our tax guide, please contact us.

Key Takeaways

While tax and financial planning should take place all year long, there are several actionable strategies to consider before year-end deadlines.

Important life events can have financial implications and should be discussed with your tax and financial advisor.

Certain investments generate more taxable distributions than others, so work with your advisor and tax professionals to evaluate your investments and after-tax returns.

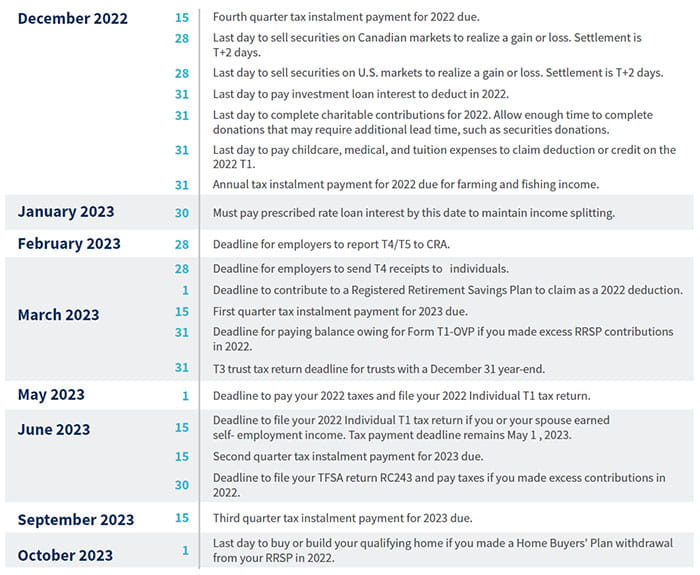

Important Dates to Remember