Designating Principal Residence Years

For a PDF version of this article click here.

Some Canadian taxpayers automatically assume that their current residence will be exempt from capital gains tax when they sell it or when they pass away. Their facts and circumstances may be simple enough for that to be a valid assumption, but many Canadians own or have owned more than one property in their lifetime.

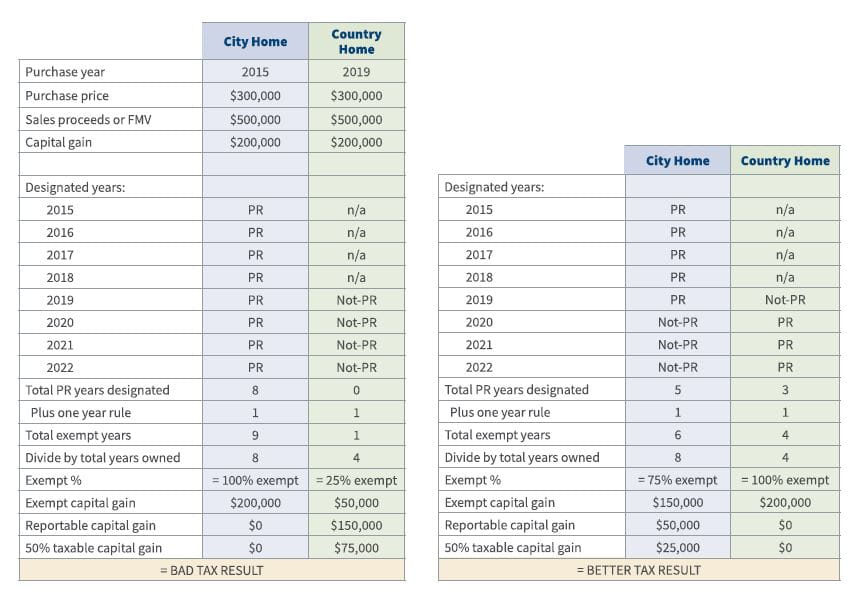

As an example, a couple concurrently owns two residences: one in the city, one in the country. They think they can sell their city home tax-free, move into their country home in retirement, and then sometime in the future sell the country home tax-free or not incur any taxable capital gains if they hold the property upon death. That conclusion is incorrect. The key word is “concurrently” in that scenario.

It is important to remember that a taxpayer/couple/family unit can choose only one property as their principal residence (PR) for each calendar year for the purposes of excluding the capital gain from Canadian taxable income. Once they have used a particular calendar year for their PR designation, it is not available for any other property. While one property benefits from the exemption, another property owned at the same time may accrue a capital gains tax liability.

The formula for the principal residence (PR) capital gains exemption is:

capital gain X the eligible number of years designated as PR plus one year / the number of years owned.

Generally, the taxpayer has to own the property, ordinarily inhabit the property, and designate the years as PR years on their tax return. Refer to the Canada Revenue Agency resource at the end of this article for the finer points of the definitions.

From a tax planning perspective, they must choose wisely when designating PR years on their tax return for the year of sale or death. Homeowners may typically designate the city home as their principal residence, but this may not be the ideal choice, depending on the exemption calculation.

If the homeowners allocate their PR exemption years more strategically, they can reduce their taxable capital gain.

“It’s tough to make predictions, especially about the future” - Yogi Berra

This illustration happens to use two properties with the same capital gain in the same disposition year to explain the concept.

However, in real life, both properties will have different gains and different disposition years. The problem with tax planning is predicting the future. How long will you hold the property? Do you know which property will have the higher capital gain when ultimately disposed of or deemed disposed? Will the market value go up or down for each property? In a hindsight is 20/20 situation, CRA provides options to revoke or amend PR designations, but penalties and interest may apply.

PLANNING TIPS

- Strategize how and when you use your PR exemption. Make the math and the tax rules work in your favour. Consider holding the property for additional years to reduce the taxable portion of the capital gain.

- Keep records of claimed designation years, especially if spouses each own separate properties and used their designations in prior years. Ensure your estate administrator has access to these records to avoid surprise tax liabilities on the terminal tax returns.

- Save invoices and receipts for your home improvements that qualify as capital costs to add to the ACB because you never know when you may change your PR election or intentions, causing your current residence to become taxable in the future.

- Non-residents of Canada are not entitled to PR years during years of non-residence, nor are they entitled to the “one plus” rule if they owned the property before establishing tax residence.

- Foreign properties are eligible for PR designation years. For example, a personal-use condo in Florida is eligible for PR designation years as long as the owner is a Canadian tax resident and they occupied the residence at some point during the year to meet the “ordinarily inhabited” rule.

- Parents should not buy a property for their adult child with the parents on legal title because the parents will not want to waste their PR years on the child’s property. The child occupying the property should be the legal and beneficial owner in order to claim their own PR years.

- U.S. citizens do not have unlimited capital gains exemptions for their principal residence. The IRS caps the home exemption at $250,000 USD per U.S. taxpayer (other conditions apply). Consider the U.S. tax implications before buying or selling a Canadian residence.

- The principal residence exemption rules and definitions can become quite complex in various scenarios, especially for changes in use from a PR to a rental property and vice versa. An excellent reference source is CRA’s Income Tax Folio S1-F3-C2, Principal Residence.

Contact us if you need help determining if an estate freeze is suitable for your circumstances.

This has been prepared by the Professional Wealth Advisory Group of Raymond James Ltd., (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not meant to replace legal, accounting, taxation or other professional advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. The information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. This is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member - Canadian Investor Protection Fund.