Activision Blizzard: A Leader in Interactive Entertainment

Activision Blizzard (“Activision”) develops, publishes, and distributes videogames for gaming consoles, PCs, and mobile devices under three operating divisions: Activision Publishing, Blizzard Entertainment, and King Digital Entertainment.

Activision owns an impressive intellectual property portfolio including some of the largest and most-popular videogame franchises such as Call of Duty, World of Warcraft, Diablo, Starcraft, Overwatch, Crash Bandicoot, and Candy Crush. In addition, Activision operates Major League Gaming (MLG), a live gaming events and streaming platform, and Activision Blizzard Studios, a film and television studio.

Activision has a strong and growing network of almost 400 million monthly active users (MAU) across all franchises, which are effectively monetized beyond the initial game sale through in-game purchases and microtransactions. We think Activision is best-positioned to benefit from industry growth opportunities (e.g. mobile gaming, esports, advertising, and cloud gaming services) than other gaming publishers and developers in the marketplace.

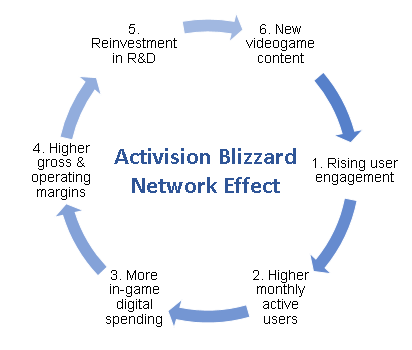

The Network Effect

We think Activision’s moat is defined by a strong network effect built around its intellectual property and brands. A moat describes a company’s structural and durable competitive advantages. A network effect is a type of competitive advantage where a product or service increases in value as the number of users expands. Activision’s network effect is perpetuated by its human capital (e.g. the videogame content creators and developers) and large base of active players that consume hours of gaming content.

We believe videogames have evolved into social networks as friends come together online to play games and socialize. In fact, Newzoo’s research shows that socializing was the number two reason people have spent more time playing video games during the pandemic [1]. We think this dynamic will continue, as the future of gaming is about establishing a wide installed user base, and creating an ecosystem where users can connect and play. In our view, Activision owns franchises like Call of Duty, World of Warcraft, and Overwatch that are best-positioned to benefit from social gaming.

Lastly, Activision operates in a relatively concentrated triple-A videogame segment that is characterized by large research and development (R&D) and marketing budgets. It is difficult to penetrate Activision’s moat due to the substantial costs and barriers to entry associated with developing a competing triple-A videogame franchise and brand.

The chart below demonstrates Activision’s network effect through an economic lens.

A Digital Shift in Videogames

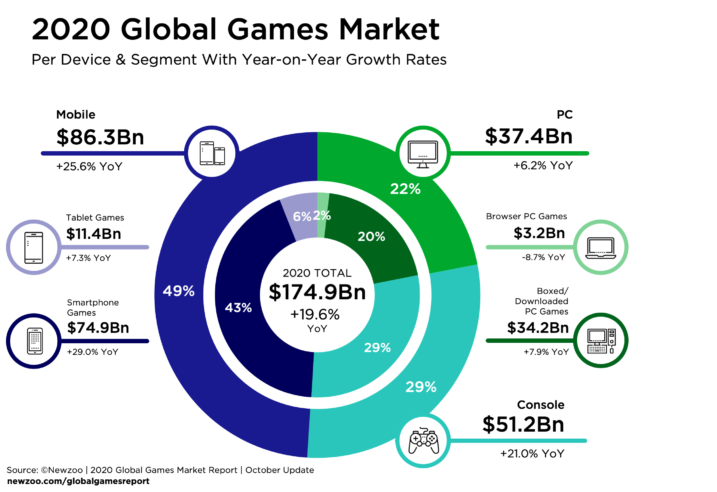

The videogame market is bigger than the music and film industries combined, with more than 3 billion people around the world playing games. Newzoo research estimates that the global videogame market will grow 19.6% to $175 billion in 2020. In the US, three out of four people, or 244 million people play video games [2]. The average video game player spent 15 hours per week playing video games in 2020, 15% more hours per week than they spent a year ago. By 2023, the global videogame market is expected to expand to $217.9 billion [3].

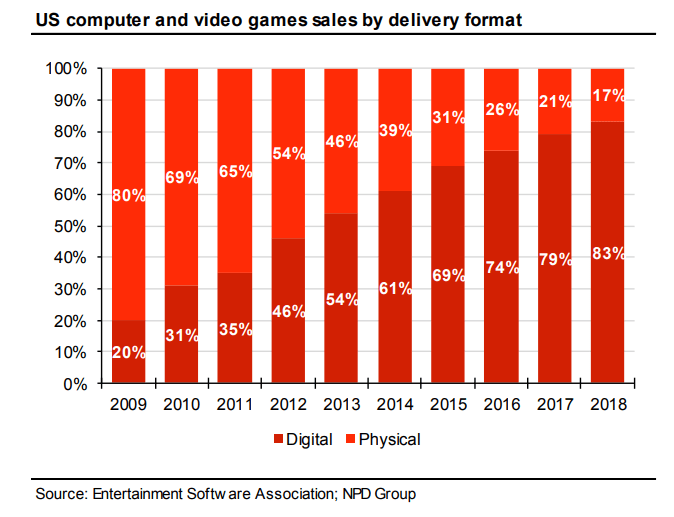

The videogame industry is evolving from physical distribution to a model that is based on digital distribution, engagement and in-game monetization. In 2009, approximately 80% of videogames sales in the US were physical, and in 2018, that number fell to 17% [4]. More consumers are directly purchasing and downloading full games digitally from publishers (i.e. Activision’s online store) or third-party online marketplaces (i.e. PlayStation Store) instead of purchasing shrink-wrapped games at Best Buy or Walmart.

The chart below illustrates the rising demand and transition to digital gaming.

The rise of digital distribution has significantly lowered costs for game publishers. This has led to higher gross margins and greater reinvestment opportunities such as post-release in-game content to improve the user experience and engagement (reinforcing the network effect stated above). For every videogame that a consumer buys digitally, the publisher makes 20% to 25% more gross profit because of the removal of the “retailer cut” as well as the absence of manufacturing and inventory costs. Morgan Stanley estimates digital gross margins are over 90% compared to physical gross margins at 70% [5]. Activision’s Call of Duty digital console mix is near 50%, and we expect that to match Blizzard and King operating divisions which are close to 100% digital over time.

Traditionally, a game publisher develops and sells a videogame to the consumer, and then right after, develops and sells another videogame to generate additional revenue. Today, publishers are focused on engaging users beyond the initial game sale by releasing new downloadable content and enabling in-game microtransactions (i.e. buying cosmetic items or weapons for your character). These digital revenue streams tend to be recurring (recurrent in-game spending) and relatively higher profit margins (over 90%). The new business model favorably extends the lifecycle of a game and maximizes the monetization potential of a game beyond the initial sale.

The chart below shows the size and growth of the global videogame market.

Key Growth Areas

We believe key growth areas for Activision include 1) mobile gaming and 2) in-game advertising.

Mobile gaming is both the largest segment by revenue and growth in the videogame market. Newzoo research estimates mobile game revenue to grow 25.6% to $86.3 billion and account for 49% of the global videogame market. Activision has top grossing mobile games in Candy Crush and Call of Duty Mobile, but the company plans to develop mobile iterations for each franchise (as well as new franchises to come) over time. This means a mobile game for World of Warcraft, Diablo, Starcraft, Overwatch, and many others. Mobile presents Activision an opportunity to expand its addressable market and reach an audience that is more than 10x the size of the console market. Going mobile will drive franchise continuity, lock-in current users, and introduce new users to the franchises and brands.

We believe in-game advertising will become an important contributor to Activision’s revenue and earnings in the next few years as mobile gaming becomes a larger part of the business. Omdia research shows revenue from in-game ads is expected to increase from $42.3 billion in 2019 to $56 billion in 2024 [6]. Our research shows that in-game ads increase engagement levels and encourages gamers to play for longer periods. If a player watches a 30 second ad video and gets an extra life or virtual-item, the willingness to play longer is increased as the player feels more capable of achieving their gaming goals with the rewards received. Comscore research shows that 48% of all gamers would like to see more rewards-based ads in a day [7].

Activision’s franchises are brand-safe. This is critical because brands will not advertise inside environments that are at odds with their own corporate values. Today, Activision generates most of its advertising revenues from King’s Candy Crush franchise. Advertising accounts for about 10% of King’s net bookings (~$150 million in 2019). We expect Activision to continue to monetize the Candy Crush user base by inserting third-party ads. But long-term, we believe Activision’s goal to bring all franchises (i.e. Call of Duty, World of Warcraft, Diablo, Starcraft, Overwatch, etc.) to mobile will present a greater opportunity to monetize the user base, and expand its advertising business.

Summary

Activision is best-positioned to benefit from 1) the new console upgrade cycle (Sony PS5 and Microsoft Series X/S), 2) the shift to a digital-first model through full-game downloads and in-game microtransactions, 3) the growth in the mobile game market, and 4) in-game advertising. Other growth areas include 1) expansion of free-to-play or F2P gaming, 2) cloud gaming, and 3) esports and media broadcasting rights.

We like Activision because of management’s consistency in execution and ability to produce and maintain high quality franchise content. The business is seeing strong sales and user engagement (hours played) across all operating divisions and franchises. Long-term, we expect gross and operating margins to expand through increasing sales of digital full-game downloads and in-game consumer spending. Activision has a strong balance sheet with ~$5 per share in net cash [8].

Risks include 1) the failure to transition console and PC franchises to mobile, 2) the lack of commercial success for new game content and releases, 3) the slowdown in consumer in-game spending and microtransactions, and 4) the competition from new developers and publishers in the console and mobile game market

Sources

- Newzoo [LINK]

- NPD Group. [LINK]

- Newzoo [LINK]

- Redeye research. [LINK]

- Morgan Stanley research on Ubisoft Entertainment SA. September 13, 2018.

- VentureBeat [LINK]

- Comscore [LINK]

- Activision-Blizzard Third Quarter Results 2020. [LINK]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Christopher De Sousa, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.